October 24, 2023

Examining the opportunities, risks, and uncertainties in the future hydrogen economy by industry sector

In the journey toward global decarbonization, the promise of clean hydrogen continues to grow. From zero-emission public transit systems and mega-plants for producing rocket fuel to the development of "turquoise" hydrogen and a world-scale green hydrogen plant, cutting-edge hydrogen projects are poised to transform a variety of industries.

Seeing the potential for innovation, governments are taking an active role in accelerating the use of hydrogen. The European Union, for example, recently mandated that 14% of all electricity be hydrogen generated by 2030. China has also announced a long-term hydrogen strategy and near-term goals starting in 2025, and India has expressed its intent to set similar policy soon.

In the U.S., the Environmental Protection Agency is taking strides to advance hydrogen through its proposed new carbon pollution standards for coal- and gas-fired power plants, released in May 2023. Under the proposed standards, facilities would have to co-fire with 30% hydrogen by 2032 and 96% by 2038. The 2022 Inflation Reduction Act also provides low-carbon hydrogen tax credits to help fund the implementation of the new rules — and this fall, the Department of Energy announced seven regional clean hydrogen hubs, awarding them up to $7 billion in funding for the development of networks of producers, consumers, and local infrastructure.

These proposals are expected to face a series of legal, technical, and political challenges, including concerns from industry about the pace, feasibility, and expense of transitioning to hydrogen. However, some major energy companies are also eager to prove just the opposite — that hydrogen technology is both mature enough and flexible enough to start pursuing decarbonization efforts more aggressively.

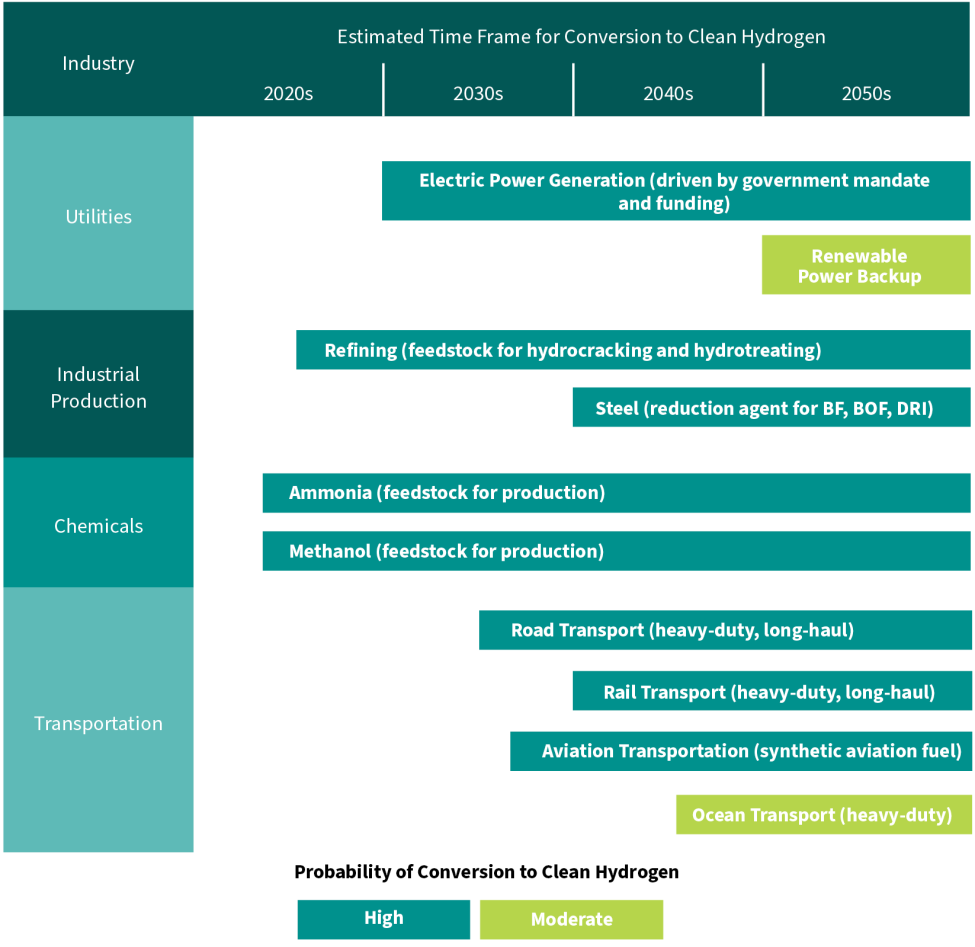

Armed with information about the time frame to conversion and various opportunities, risks, and uncertainties, companies can strategically select and pursue projects with higher probabilities of economic, technological, and environmental success.

Hydrogen energy project considerations

Ultimately, capturing the potential of hydrogen means different things to different industries and different players within those industries. While green hydrogen and other developing hydrogen technologies offer a clear path to more sustainable, climate-conscious operations for carbon-heavy sectors (particularly those that cannot be easily electrified), there is no uniform playbook for their deployment. While some sectors face fast-approaching mandates, many others are being incentivized through tax credits, grants, and funding opportunities.

To understand the realities of transitioning to hydrogen at scale, industries and sectors must consider factors such as:

- Present energy source

- Regulatory requirements

- Technological readiness

- Cost of conversion

- Government assistance/subsidy

- Asset-replacement cycle

- Economic competitiveness with other green energy sources

Leveraging Exponent's cross-industry and multidisciplinary expertise, our analysis breaks down what "hydrogen ready" entails across a range of industry sectors, including relevant considerations and key hurdles for each — and where a hydrogen-powered future may not be realistic or feasible at all. Armed with information about the time frame to conversion and various opportunities, risks, and uncertainties, companies can strategically select and pursue projects with higher probabilities of economic, technological, and environmental success.

Getting Hydrogen Ready — Time Frame to Conversion for Transitioning Sectors

Utilities: high potential tempered by logistical and interconnection challenges

Electric power and renewables

For utilities, power generation using hydrogen may be sensible if long distances need to be bridged, as hydrogen transport by pipeline may be advantageous compared to transmission lines. In some states such as Texas, new pipelines face fewer obstacles during permitting compared to new transmission lines. Whether hydrogen pipelines are more economically viable is still subject to debate.

In addition, hydrogen is also being discussed as a solution to intermittency in renewable power generation. First demonstration projects such as Aces Delta for clean hydrogen production, storage, transmission and energy generation are underway. Using hydrogen for energy storage can potentially bridge time spans not currently covered by the accelerating deployment of grid-scale batteries, despite higher inefficiencies in the energy conversion steps.

For even longer-term energy storage, however, no plausible technology has been proposed that could smooth seasonal imbalances in power generation systems. Many solutions for this application face unfavorable economics due to low-capacity factors and the need for extremely large storage.

Residential and commercial heating

In many cases, fossil fuels heat residential and commercial buildings and provide fuel for ranges, ovens, fireplaces, clothes dryers, and other applications. Utilities currently supplying customers with fossil fuels may be interested in continuing this business by partially blending hydrogen into their fuel, in particular, since customers may be reluctant to swap existing appliances for electrical appliances.

While utilities look at hydrogen blending as a potential strategy, they will need to verify the hydrogen compatibility of distribution piping.

Industrial production: good potential with different timelines

Today, most hydrogen used in industrial production is produced from natural gas by steam methane reforming (SMR), i.e., "gray hydrogen." Gray hydrogen is used in petroleum refining for hydrocracking and hydrotreating to upgrade fuels and meet sulfur impurity standards. It is primed for conversion to clean hydrogen beginning this decade.

The carbon footprint for refining can be reduced in two ways. Carbon capture and sequestration technologies can be added to existing SMRs or other fossil-fuel based hydrogen production methods for "blue hydrogen," where carbon dioxide emissions are either reused or stored. Alternatively, renewable electric energy, generated using solar, wind, and hydroelectric power, can be used to split water through electrolysis and produce "green hydrogen," with zero-carbon emissions.

The steel industry also represents a good opportunity for hydrogen but with a longer timeline, as the necessary process changes are more substantial including replacing blast furnaces. Globally, steel production produces more carbon dioxide than any other industrial process, around 8% of total global emissions. The predominant process for producing steel today involves an integrated blast furnace (BF) or basic oxygen furnace (BOF). Coal and coke (carburized coal) are the primary fuels used in this process. Direct reduced iron (DRI), typically produced from iron ore using natural gas, is projected to play a larger role in steel production moving forward.

The steel industry is currently exploring reduction processes that can use hydrogen for BF, BOF, and DRI processes. However, compared to the more limited changes to hydrogen generation in a refinery or fertilizer plant, investments for a new iron ore reduction process in the steel industry are associated with multibillion-dollar cost. Without increased regulatory requirements and government funding, widespread use of hydrogen in steel production may not occur for another couple of decades — but, in time, it will likely move in that direction.

Another transportation sector exploring clean hydrogen energy is aviation. While some propose direct use of hydrogen onboard planes, synthetic aviation fuel (SAF) is a more plausible first step for the industry.

Chemicals: low-hanging fruit with unique challenges

The chemical industry has a long track record of using hydrogen as feedstock, either pure or as part of synthesis gas that also contains carbon monoxide. As with refining using gray hydrogen, the production of important basic chemicals such as ammonia and methanol is ripe for conversion to clean hydrogen beginning this decade.

With ammonia production, where pure hydrogen is used, blue or green hydrogen can be used as a drop-in solution. In the case of methanol or other processes using synthesis gas, green hydrogen lacks the readily available carbon source of grey or blue hydrogen. Here, additional technologies will be needed — e.g., utilizing carbon dioxide captured from other plants or directly from the air.

Regulatory pressure and available technologies are primary drivers for the shift from gray to blue and green hydrogen in this basic chemical production, and conversions are relatively uncomplicated. The availability of government production and investment tax credits should help accelerate the transition. However, potential challenges include a developing regulatory regime and technical risks in scaling-up technologies not yet fully proven at the required scale.

Another promising application of hydrogen is generating heat for reactions. Today, natural gas or other fuel gases heat cracking furnaces that split longer-chained hydrocarbons into shorter, more reactive precursors for many polymers and other important chemicals. Combusting hydrogen can generate similar conditions. Important questions include material compatibility to the increased water content, changes in the emissions profile, and economic feasibility.

Transportation: diverse uses, economic considerations

Technical advances, a reduction in the cost of lithium-ion batteries, and federal credits have made electric passenger vehicles economically attractive and a leader in this mobility sector. But heavy-duty, long-distance transport of freight by truck or rail may look to hydrogen as a fuel that balances carbon reduction and practicability considerations. Battery-powered electric transport trucks and trains do not offer the same advantage in these applications. Time to refuel and higher energy density (with a corresponding lower weight versus large battery packs) favor hydrogen for long-distance mobility.

Another transportation sector exploring clean hydrogen energy is aviation. While some propose direct use of hydrogen onboard planes, synthetic aviation fuel (SAF) is a more plausible first step for the industry, as it allows the use of existing assets and infrastructure. Maritime shipping is also exploring options for alternative fuels, and many options proposed directly or indirectly — in the case of ammonia or methanol — depend on clean hydrogen energy.

Long-distance overland transport of freight and aviation is more likely to adopt clean hydrogen energy sooner than maritime shipping. For one, they are more affected by current emerging regulations. Additionally, customers looking to meet their own ESG commitments may specifically ask for less carbon-intensive transportation options. With SAF, aviation can also make use of existing assets and infrastructure. On-road freight transport has a relatively short asset replacement cycle compared to maritime shipping, giving its timeline a boost over sea-borne vessels. Rail transportation in the U.S. still relies heavily on internal combustion engines compared to other countries that have electrified larger sections of their network, a result of the vast distances in the U.S. Hydrogen may be a promising alternative but faces rail's notoriously long asset replacement times.

Strategic considerations for clean hydrogen energy projects

As companies consider clean hydrogen energy projects, a lifecycle assessment (LCA) may be a good starting point to understand the potential upsides hydrogen can offer. An LCA should encompass a rigorous scientific examination of the economic, technological, and regulatory risks and rewards to help guide a successful project or avoid one that is more speculative with greater potential hazards.

The road to clean hydrogen use will affect many sectors. Overall, however, not many have strong experience in generating, handling, storing, and using this extremely flammable compound. While hydrogen already has many industrial applications, it is still a novelty for transportation and other sectors, and even in established industrial applications, the introduction of new production processes such as water electrolysis or carbon capture technologies can lead to unforeseen risks or failures. To advance in their journeys, interested parties should carefully evaluate the benefits and drawbacks of hydrogen for their application, understand the maturity of the technology, and closely monitor the hydrogen regulatory environment as it continues to evolve.

What Can We Help You Solve?

Exponent's multidisciplinary technical and regulatory experts help clients understand the opportunities and risks of new hydrogen applications, including the challenges facing blue and green hydrogen production; flammability and toxicity issues; financial disclosures for hydrogen conversions; and the technical implications of capturing, sequestering, or using carbon dioxide for blue hydrogen production.

Hydrogen Systems & Fuel Cell Technologies

Innovate with new hydrogen technologies and solve challenges with electrolyzers, fuel cells, liquefaction technologies, and ammonia conversion systems.

Sustainability

Meet changing sustainability regulations with rigorous science and experienced consulting services.

Power & Energy

Multidisciplinary support for high-power energy systems of all sizes in a variety of applications.

Pipeline & Process Piping

Mechanical engineering expertise for pipeline construction, pipe corrosion, pipeline integrity management, and pipeline failure analysis.

![Chemical Engineering [TS]](/sites/default/files/styles/cards_home_card/public/media/images/GettyImages-1219894397.jpg?itok=jSudNzDi)

Chemical & Biochemical Engineering

Occupational safety and equipment evaluations, risk assessments, accident investigations, and data modeling for profitable practices.

Process Safety Hazards & Risk Analysis

Thermal science expertise to help you Identify hazards, mitigate risks, and improve safety and compliance with regulatory practices