June 22, 2023

UpdATED September 2025

As use cases for grid-scale batteries grow, utilities must develop strategies to overcome interconnection queue roadblocks

In April 2022, just days after connecting a 182.5-megawatt battery to the grid, the California Independent System Operator charged up its football-field sized array of lithium-ion storage batteries with mid-day solar at a cost of $10 per megawatt/hour. That same evening, the grid operator sold and discharged that stored power on wholesale markets for $100 per megawatt/hour.

Storage arbitrage is one of many quickly emerging use cases for grid-scale batteries that is both strengthening the grid and incentivizing renewable power generation — even as grid-scale battery projects face yearslong delays in U.S. interconnection queues. An interconnection queue is an inventory of power generation, storage, and transmission projects (ranging from early planning stages to fully operational) requesting to connect to the power grid.

Solar, wind, and grid-scale battery storage compose the vast majority of projects in the interconnection queues, but they are hindered by a nationwide lack of new transmission capacity to integrate renewables.

To help build tomorrow's grid, power developers, transmission planners, battery storage project managers, and other energy sector stakeholders will need to collaborate to address the challenges involved in reducing today's wait times for bringing new grid-scale energy storage online — including critical upfront intelligence on interconnection processes and battery requirements.

Grid-scale battery projects face transmission capacity issues, backlogs for connecting renewable energy

California's grid previews a future where grid-scale batteries perform services highly valued by electricity markets. Since 2020, the state has deployed more grid-scale batteries than anywhere else on the globe, including nearly doubling its capacity between 2022-2024. Over 40% of the grid-scale battery capacity in California was used for price arbitrage, according to the most recently available reports from the U.S. Energy Information Administration. Beyond arbitrage, utilities now also derive considerable market value from battery storage that performs signal regulation, voltage support, peak shaving, and black-start reboots.

Yet as battery storage unleashes new capabilities, the developers and stakeholders of new power generation and storage projects find themselves lingering in the U.S. interconnection queues with an average wait time of five years, according to a Lawrence Berkeley National Laboratory study. At current rates, less than a quarter of the energy projects entering U.S. interconnection queues will make it to completion, as developers and energy providers struggle with the limitations of existing infrastructure and transmission lines to support new projects — as well as who will pay construction costs when new or upgraded infrastructure is required.

And things seem to be getting worse. At the end of 2023, approximately 2.6 terawatts of generation and storage capacity are stuck in queues around the country. That's more than 1.5 times the current installed electrical capacity in the entire U.S.

Misinformation and misfires in proposed projects

Despite roadblocks, grid-scale battery projects remain in high demand. Incentives provided by the Inflation Reduction Act are projected to be available through at least the end of 2025, the Department of Energy's Smart Grid grants will remain in effect until 2026, and several state initiatives continue to support the future of grid-scale investment.

However, the push to expand grid-scale projects even as they fall further behind has led to scrutiny about the interconnection process. Advocacy organizations for storage and renewables, like the non-profit Interstate Renewable Energy Council, have identified policy improvements for transmission providers to release more high-quality, public information about interconnection capacity constraints, hosting capacity, and circuit strength, which could redirect certain applicants to different regions or help them better understand gaps in their proposals.

As it stands, Federal Register filings from the Federal Energy Regulatory Commission (FERC) state that power project developers typically receive insufficient data on possible points of interconnection, "Therefore, developers often submit multiple interconnection requests for proposed generating facilities at various points of interconnection, not all of which are expected to reach commercial operation, as an exploratory mechanism to obtain information to allow them to choose the most favorable site."

The result of these misaligned incentives is a lineup of nearly 12,000 projects. Across the energy trade press, stories of promising renewables projects stuck in interconnection queues describe major renewables installations facing start-to-finish spans of eight years, a community solar project told to wait 15 years for application review, and a 570-megawatt wind farm proposal that spent five years and $2.5 million in deposits waiting on interconnection, before dropping out in 2022 after being told that grid connection fees would instead total $48 million.

As grid-scale battery storage grows, edge cases of energy storage being tasked with integrating increasingly large amounts of decentralized power production will grow as well.

With better information on grid conditions and thorough assessments performed earlier, interconnection applicants could revise their proposals to make better decisions on interconnection fee structures and where existing infrastructure can support their plans.

From "first come, first served" to "first ready, first served"

To accelerate wait times, storage developers, regulatory agencies, and other grid stakeholders are moving to transform interconnection from a "first come, first served" model to a "first ready, first served" process that prioritizes the most thoroughly analyzed projects with the most promising feasibility, system, and grid integration studies. In July 2023, FERC released its much-anticipated rule, Order 2023, finalizing interconnection reform.

However, there remains a lack of standardization across states of how to best enable "readiness" and best practices continue to evolve. Freeing the Grid has released a graded system, scoring individual states' interconnection procedures.

One essential step is conducting a grid integration study that simulates the operation of storage or power generation at the system level under varying reliability constraints to provide grid operators, regulators, and policymakers with models of operations, emissions, and costs. Exponent has expertise in identifying the technical study scenarios given the project location and queue, as well as reviewing the technical study reports to provide insights on the next best approach to be "first ready." Additionally, Exponent can help identify and mitigate risk throughout the interconnection process and manage projects through various phases to ensure that all interconnection requirements are met.

As grids evolve, batteries and standards adapt to serve broad use cases for reliability, resilience

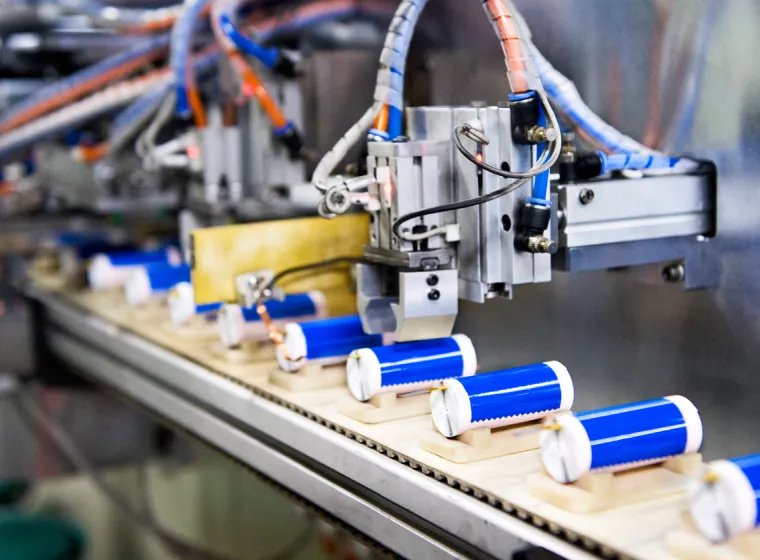

Given the range of use cases for energy storage, choosing and configuring grid-scale batteries means assessing the battery's chemical makeup and connectivity with balance-of-system components. The diversity of energy storage functions also means that a grid-scale battery cannot be considered an out-of-the box item with completely interchangeable components.

To bolster their viability, some energy storage projects will need to deploy or reconfigure batteries to allow utilities to save or defer local infrastructure costs. Other power operators, looking even further into renewables' future, are planning to deploy complementary arrays of vanadium-redox or sodium-ion grid-scale batteries. Though far from being widely commercially available, these alternative battery models offer the potential of longer lifespans and wider elemental abundance while requiring significant tradeoffs in terms of cost, size, and commodification.

Meeting regulations to keep moving through the interconnection queue

As grid-scale battery storage grows, edge cases of energy storage being tasked with integrating increasingly large amounts of decentralized power production will grow as well.

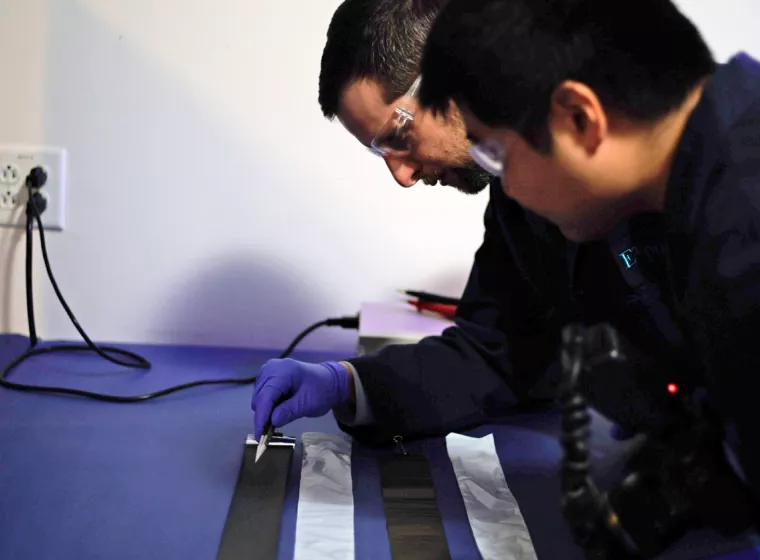

Exponent has been working for years to understand how the interconnection process serves grid-scale battery projects, particularly when local regulations for energy storage may lack consistent parameters or when testing processes or use procedures are complex. State and local permitting processes also include environmental aspects that can further complicate the completion of projects. Our ability to bring together battery design reviews and quality assessments with considerations related to their materials, construction, temperature, local outdoor operational environments, environmental reviews, and site-specific hazards can significantly reduce risk. Taking corrective actions can both improve safety, assist local or state regulators struggling with the new technology, and help ensure the right performance of the battery.

With rapid growth of use cases for grid-scale battery deployments, standards for testing grid-scale battery systems are evolving rapidly as well. Since 2019, each year has seen the addition of a new domestic or revised global standard. Meeting these regulations is required for most large-scale projects to receive financing and approval and to advance through the interconnection queue.

One such standard for a battery energy storage system (BESS) is UL 9540A (described below), a test method that generates data to inform the risk of a propagation of failures in a BESS due to a single thermal runaway event. This assessment can demonstrate how features that have been integrated into the system will affect the battery's overall performance during a safety event as well as the system's resilience (or susceptibility) to a propagation of failures.

The application of UL 9540A test data — conducted at the product level — often requires interpretation when considering system performance on a unique site. Authorities having jurisdiction (AHJs) may request clarification on the meaning of the reported test results, and the BESS operators may need assistance in determining how the data inform other site procedures such as fire alarms and emergency response. Many jurisdictions now have requirements for listing equipment to UL 9540 (which includes reference to UL 9540A), but many BESS products have not yet completed evaluation for listing to UL 9540.

As the growing number of grid-scale battery projects confronts local, state, and federal regulatory processes and other interconnection barriers, connecting to the grid in a cost-effective and timely manner may determine whether a project moves forward.

Exponent can assist in determining how existing testing and quality checking for a BESS product aligns with UL 9540 requirements and where AHJs may desire further information. For battery reliability, accelerated aging analysis and lifetime simulation studies can help evaluate potential performance or safety issues in cells, modules, and the larger system. Many of these tests do not include a "pass" or "fail," often requiring expertise for interpretation and understanding of all parts of the system.

New protocols for installations can create configurations that isolate faulty cells and keep electrical energy from spilling into neighboring cells, increasing overall battery safety. In addition, several years of interagency studies have created detailed protocols for fire detection and suppression, exhaust ventilation, explosion control, gas detection, and managing stranded energy.

Unlocking grid-scale batteries' potential

As the growing number of grid-scale battery projects confronts local, state, and federal regulatory processes and other interconnection barriers, connecting to the grid in a cost-effective and timely manner may determine whether a project moves forward. Exponent provides a supportive framework for project developers to analyze resource potential, grid impacts, site viability, transmission resources, battery configuration, and system performance.

With so much potential energy storage waiting in U.S. interconnection queues, grid-scale batteries make up much of the new capacity waiting in long lines to join the grid. Yet with continued low project completion rates, proposals for storage will need regulatory reform, well-vetted grid integration studies, and thorough integration with balance-of-system components to support the country's energy transition over the course of the next decade.

Grid-Scale Battery Storage Standards

Exponent helps utility clients stay apprised of the latest standards and requirements for grid-scale energy storage projects. In just the past three years, collaborations among the Department of Energy, International Code Commission, Underwriters Laboratories, the National Fire Protection Association, and Sandia National Laboratories have resulted in new standards and revised codes that include detailed "lessons learned" from previous safety incidents at energy storage systems.

What Can We Help You Solve?

Exponent's multidisciplinary consulting staff closely monitors the continually changing regulatory landscape for power storage, grid-scale batteries, energy integrators, and balance-of-system components. We can help you manage the interconnection processes from start to finish by identifying and mitigating risks in a timely manner to maintain project schedules and control costs.

Batteries & Energy Storage

Supercharge performance, reliability, and safety across all stages of the battery and energy storage product lifecycle.

Custom Battery Testing

Custom product safety, performance, and industry certification battery testing services.

Battery Failure Analysis & Investigation

Comprehensive battery failure analysis to determine the root causes of failures and identify opportunities for mitigation.

Battery Vendor Evaluation Services

Independent, objective analyses that empower innovative, reliable battery product journeys.

Battery Design Review, Quality & Safety Assessments

State-of-the-art battery design, performance, quality, and safety assessments to support manufacturers' requirements and industry standards.

Battery Supply Chain Services

End-to-end battery supply chain support including evaluating potential manufacturer partners and suppliers