July 31, 2025

The One Big Beautiful Bill Act introduces an influx of investment and development challenges for the critical minerals and rare earth mining industry

In recent years, demand for critical minerals, including lithium, cobalt, nickel, and rare earth elements, has surged amid the global shift toward electrification, advanced manufacturing, and renewable energy. In response to geopolitical concerns and supply chain vulnerabilities, the U.S. has enacted sweeping legislative reforms to bolster domestic mining initiatives. Provisions in H.R. 1, the One Big Beautiful Bill Act (OBBBA), represent the latest shift in federal policy, offering billions in federal funding and modified financial incentives designed to restrict access to Chinese companies and bolster national mineral security.

Meanwhile, high-profile private sector deals — such as the Pentagon's investment in MP Materials and Apple's $500 million rare earth magnet agreement with the same company — underscore a broad push for reshoring of U.S. minerals mining.

How is the regulatory landscape for critical minerals mining changing?

OBBBA, signed into law July 4:

- Appropriates $7.5 billion to the Department of Defense for critical minerals projects.

- Eliminates the Section 45X Production Tax Credit phaseout exemption introduced in 2022's Inflation Reduction Act. Critical minerals produced in 2031 will be eligible for 75% of the credit, with this percentage lowered annually until the credit is eliminated for critical minerals produced after 2034.

- Provides a more restrictive definition of Foreign Entities of Concern (FEOC), expanding the scope of companies disqualified from receiving benefits. Combining the Specified Foreign Entities (SFEs) category with one known as Foreign-Influenced Entities (FIEs), OBBBA creates a new grouping called Prohibited Foreign Entities (PFEs), barred from 45X credits beginning in 2026.

Paired with critical minerals mining permitting reform initiatives embedded in 2023's The Lower Energy Costs Act, OBBBA's provisions have the potential to further accelerate critical minerals exploration and extraction projects and timelines in the U.S. and globally, for companies not barred as PFEs, while the 45X phaseout schedule may disincentivize investment in greenfield critical minerals mining projects with longer developmental timelines.

What's next for U.S. critical minerals mining stakeholders?

The global market for critical minerals continues to evolve rapidly. In the U.S., the Federal Permitting Council recently added ten domestic mines and mining projects to the FAST-41 list (Title 41 of the Fixing America's Surface Transportation Act) to expedite the permitting process. For mining organizations, the combination of expedited permitting, financial incentives, an influx of investment from the U.S. federal government, and high-profile public-private partnerships represents both opportunities and challenges. Success in this environment will require:

- Up-to-date knowledge of legislative and policy developments under OBBBA

- Strategic engagement with the U.S. federal government to drive and fund projects that both extract and process critical minerals and rare earth minerals

- Proactive engagement with federal and state regulators

- Comprehensive environmental risk management frameworks

Despite U.S. federal investment initiatives, mining organizations continue to navigate a complex web of environmental compliance obligations and potential areas of environmental and human health liability. Maintaining robust monitoring, reporting, and mitigation plans representing best practices throughout the project lifecycle and performing rigorous environmental impact assessments can help address potential impacts from extraction and processing activities on water quality and biodiversity in mining-affected regions.

As legislative frameworks and specific implementations of those frameworks continue to take shape, organizations that can unlock domestic growth opportunities for critical minerals and rare earth element mining while mitigating potential impacts on sensitive habitats and water resources are likely to maintain a competitive edge.

What Can We Help You Solve?

Exponent's mining consultants partner with clients to address challenges and unlock opportunities presented by emerging legislation impacting critical minerals mining. Our multidisciplinary team of scientists, engineers, and regulatory experts help mining operations navigate complex regulatory requirements and perform rigorous environmental impact assessments to mitigate environmental, human health, and organizational risk.

![[EBS] Ecological & Biological Sciences - Environmental Risk Assessment - grey heron grazing in fresh water](/sites/default/files/styles/cards_home_card/public/media/images/grey-heron-2022-01-04-23-54-37-utc%281%29_0.jpg.webp?itok=5EB0lXjA)

Environmental Risk Assessment

Risk assessments for legacy spills and contamination, potential project and product impacts, and environmental remediation support.

Environmental Permitting

Extensive support for compliance with local, state, and federal permitting requirements.

Modeling & Analysis

Experienced environmental analysis and data modeling for a range of complex environmental challenges.

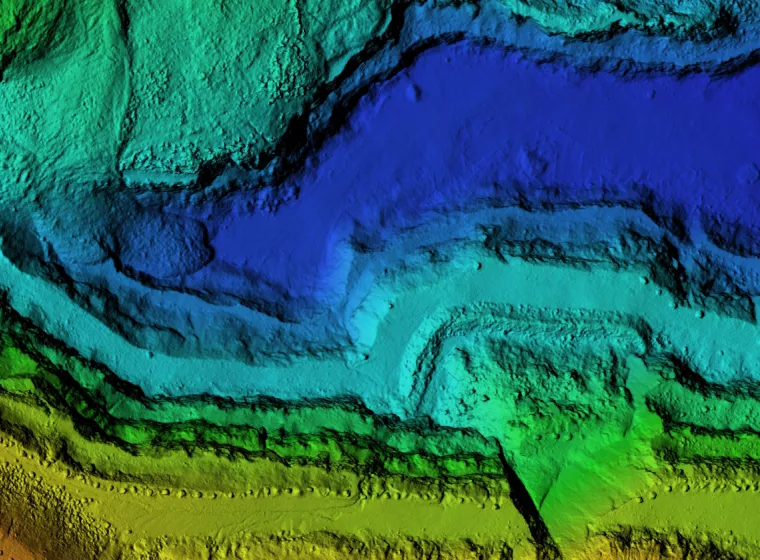

Earthwork & Grading

Effective ground evaluations to support infrastructure planning and projects.

![Mining [CE]](/sites/default/files/styles/cards_home_card/public/media/images/GettyImages-1139148636.jpg.webp?itok=UlJkqJCd)

Differing Site Conditions

Objective analysis for all aspects of DSC claims.

Industrial Contamination Management

Expert environmental services for a range of complex industrial contamination challenges.