October 12, 2023

The EU's sweeping Battery Regulation imposes new requirements and creates new design, reporting, and sustainability challenges for global manufacturers

To comply with the EU's newly enacted Battery Regulation, global makers of vehicles, consumer electronics, and batteries have four years to redesign their products, adopt sustainable practices, and document a new set of due diligence obligations.

As many manufacturers are realizing, this EU regulation has the potential to overhaul the battery industry. Enacted this July, the new set of regulations is vast — containing 79 binding articles — and aims to ensure nearly all EU batteries will be collected, recycled, and reused across the entire value chain.

In terms of enforcement, the Battery Regulation will introduce declaration requirements and place limits on the carbon footprints of electric vehicles beginning in 2025. A mandate for consumer-replaceable batteries for phones, tablets, gaming consoles, scooters, and most portable electronics will take effect in 2027.

Collectively, these requirements are forcing manufacturers to adapt their designs to an unprecedented regulatory framework for the circular economy of batteries, their components, and recovered metals across the EU's 27 Member States. However, since these rules apply to any entity making, selling, or distributing batteries in the EU, they will have implications for battery producers and manufacturers around the world.

A replaceable battery mandate with a global impact

From smartphones and handheld gaming devices to EVs and scooters, the EU Battery Regulation is direct and clear: batteries must be "removable and replaceable by the end-user."

Manufacturers have just over three years to meet that demand and redesign for replaceable batteries across a huge array of electronics and mobility applications, posing a new and evolving set of questions to be considered across the value chain.

- Product functional design: How will product performance be achieved while allowing for a battery to be removable and replaceable?

- Product safety: How can manufacturers ensure product safety while also making battery packs removable and replaceable? What potential new risks could be introduced through the replacement process and how could they be mitigated?

- Regulatory compliance: How will manufacturers ensure that once a battery is replaced, the product still complies with relevant regulations, particularly where full-systems testing might be needed to prove conformity?

- Third-party components: How will third-party components be factored into the replaceability and repairability of a product? How much collaboration with third parties should be expected?

- Postmarket support: What planning is needed for postmarket support of repairable products? Will additional resources be needed to deal with problematic repaired products or the consequences of related product failures?

- Supply chains: Will OEMs also provide spare parts? If so, what is required to integrate them into supply chains and make them available to end users? Will tools be provided for repair purposes?

As industry grapples with the many new questions that are poised to redefine the next generation of battery-powered technologies, we see three core areas that can help drive answers across each part of an evolving product lifecycle: user safety, product performance, and end-of-life considerations.

New user requirements, new design considerations

In the early 2000s, swappable batteries were the norm in smartphones and tablets. However, for close to two decades, the progression of embedded battery units has allowed manufacturers to achieve svelte product profiles with built-in water and dust resistance that digital-native consumers have come to expect.

As modular battery designs may be reintroduced for a new generation, manufacturers will be required to design for a replacement process that remains accessible to as many users as possible. From a human factors perspective, that means appreciating potential hazards that such newfound accessibility and related interactions could pose to consumers and appropriate strategies to address those hazards. For example, depending on the form factor and design of the battery pack and its enclosure, one might consider:

- Complementary battery pack and compartment designs, such as including a forcing function, to avoid misalignment or incorrect insertion that could damage the battery or connectors

- Visual, tactile, and potential auditory cues to reinforce correct installation

- Simple fastening mechanisms and user-friendly enclosures

- The availability of spare parts

- Clear instruction guides and safety information

As the Battery Regulation mandate excludes the use of specialized tools for battery removal, designers may also want to consider how the battery and compartment can be shaped for ease of opening, gripping, and handling without inadvertent access, slipping, or the use of excessive force — and how to accomplish that while maintaining the sleek aesthetics that are the hallmark of today's consumer electronics.

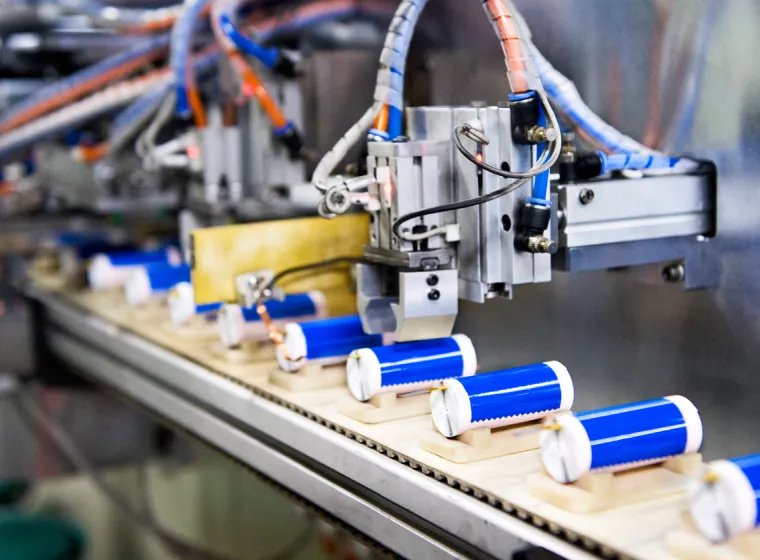

Boosting battery recycling is a key goal of the EU Battery Regulation and other emerging regulations, giving manufacturers a critical role to play in establishing a circular economy.

New operating environment, new testing protocols

Manufacturers accustomed to thermal modeling and testing for batteries will also want to start thinking about the transition from fixed to removable batteries. Replacing batteries may involve risks that existing product tests do not fully cover in terms of design, reliability, foreseeable use, and environmental factors.

Replaceable batteries can also pose challenges for managing thermal performance, since heat transfer to and from a replaceable battery may vary substantially from replacement to replacement. Software and hardware calibration must also be addressed as manufacturers face the reality of consumers using various third-party replacement batteries in their devices.

In addition, replaceable batteries can increase the risk of battery faults, as user-led battery swapping could introduce misuse, abuse, and unexpected damage mechanisms among both batteries and associated electronics within their packs where there was no such concern before.

To overcome these challenges, manufacturers may need to evaluate considerations such as:

- Conducting human factors studies and user research to better understand how consumers approach replacing batteries in particular products to get ahead of unexpected use cases that might cause performance or safety issues.

- For example, are the instructions provided understandable and easy to follow? Is the battery change process associated with any critical errors that might expose users to hazards? Does the new design inadvertently encourage or lead to the use of unintended tools, e.g., a kitchen knife, used to open the battery compartment? Is there a high chance of the battery being dropped during the swap? Who is the typical user or target demographic and how might their characteristics (e.g., physical, cognitive, or developmental limitations and impairments) impact the process?

- Ensuring critical performance and safety aspects of the device can still be maintained with a replaceable battery design.

- Since batteries that are directly integrated into products typically have better energy density and better thermal conductivity, are different sizes or component orientations necessary to achieve the same performance with swappable batteries?

- New testing for product reliability under multiple changes.

- How many changes can be carried out before fatigue or damage to the battery becomes a factor? Are battery/device electrical and thermal contact resistances maintained over multiple swaps?

- Safety testing for the replaceable battery pack in isolation.

- Swappable batteries may require additional safety features to be built into the replaceable battery pack itself, such as short circuit protections. Will removable batteries lead to more over-discharge risks when stored for long periods outside the device?

New sustainability goals, new end-of-life considerations

Boosting battery recycling is a key goal of the EU Battery Regulation and other emerging regulations, giving manufacturers a critical role to play in establishing a circular economy.

Some of the ways manufacturers can start thinking about end-of-life considerations in this new context include:

- Providing instructions and incentives that promote proper collection of replaceable batteries for consumers

- Collaborating with independent, third-party repair services, which will play an expanded role in providing spare parts and replacement batteries to meet the regulation's sustainability goals

- Building a repair/recycle system directly into the supply chain of the spare part itself (e.g., printer cartridges)

The EU has taken the first steps for end-users to replace their batteries and reliably track their condition and carbon footprint on a continent-wide level, but the impact will not be limited to geographical borders.

Putting it all together

At the highest level, the Battery Regulation's many declaration requirements — specifically its design and information mandates — create a traceability system for batteries and their metals and components, compelling manufacturers to keep recyclability top of mind.

Developing a battery passport and a due diligence policy that is clearly communicated to suppliers and consumers — and tracking the complete lifecycle of a battery — will be among the largest challenges facing manufacturers' current reporting capabilities.

Due diligence policy: Manufacturers will be newly obligated to track social and environmental risks linked to the sourcing and processing of battery raw materials such as cobalt, lithium, nickel, and graphite. As detailed in Article 48 of the Battery Regulation, these due diligence policies apply to manufacturers selling rechargeable industrial batteries, batteries for light means of transport (LMT), and EV batteries with a capacity above 2kWh.

Due diligence obligations will also require companies to develop or establish systems to demonstrate the transparency of their supply chain — including the identification of upstream actors. For manufacturers, meeting these reporting obligations will require conducting risk mitigation assessments and establishing grievance mechanisms, such as early-warning risk awareness and remediation programs to address social and environmental factors.

Digital battery passport: According to the new regulation, LMT batteries, industrial batteries with a capacity above 2 kWh, and EV batteries will be required to have "digital battery passports" (scannable QR codes) that identify the manufacturer, provide supply chain traceability information, and display capacity, chemistry, and carbon intensity. The intent behind the passport is to further a sustainable and reliable circular economy for batteries through improved data availability across the value chain.

Given the demands of achieving compliance with the battery passport mandate, the EU has established a Battery Pass Consortium across industry and science partners to guide manufacturers as they meet phased-in reporting requirements (as many as 120 data points will be required) for their battery products' passports.

In addition, battery makers must encode these digital passports with details about charging and discharging cycles and temperatures to which the component has been exposed and for how long. The battery passport must also include the product's entire carbon footprint, from material extraction in mining to production and instructions for end — of-life recycling and materials recovery.

To deliver on these data requirements, independent assessment organizations will play a larger role as the sector strives to meet the EU's circular economy goals. In addition, compliance with due diligence obligations must be verified by a conformity assessment body in the relevant EU Member State.

End-of-life management and circular economies: The regulation introduces extended producer responsibility for managing batteries at the end-of-life stage as well. The legislation states that producers should be prepared to finance the costs of collecting, treating, and recycling all collected batteries as well as carrying out compositional surveys of municipal waste to gauge the extent of waste battery disposal taking place.

Manufacturer-led recycling efforts will be critical to meet the legislation's material-specific recycling targets and minimum requirements for recycled content in batteries. For example, lithium, which is only minimally recycled today, will need to be recovered and recycled at rates of 50% by 2027 and 80% by 2031. Lithium batteries, similarly, must meet recycled content targets of 6% by 2031 and 12% by 2036.

To meet these goals, manufacturers are incentivized to ensure recycling programs are in place for their products. Addressing this aspect of the lifecycle of a battery will be a new undertaking for producers who must now consider the recovery of the many valuable resources contained in batteries. In addition, new batteries placed into devices will need to be manufactured using minimum amounts of recycled battery materials. The EU rules of origin for products may also place additional requirements on where the recycled battery materials originate; this will create additional considerations for where recycling happens in relation to the point of manufacture or sale of the product itself.

Regulations position batteries as key lever in global green transition

The Battery Regulation will unfold in the EU as the demand for lithium-ion batteries is expected to increase sixfold by the end of the decade. To meet these sustainability requirements in the same critical time frame, manufacturers need to make timely design choices and testing decisions to ensure their batteries are replaceable, more sustainable, and more durable while maintaining performance and function.

The EU has taken the first steps for end-users to replace their batteries and reliably track their condition and carbon footprint on a continent-wide level, but the impact will not be limited to geographical borders. Any company that intends to sell products in the EU will be responsible for matching regional requirements, with the strong likelihood of immediate impacts to other markets, particularly the U.S.

To both iterate on longstanding electronics products and meet the many battery sustainability targets that will occur between now and 2031, all battery manufacturers can benefit from rethinking consumer-friendly designs; anticipating new relationships between producers, users, and recyclers at each stage of the value chain; and cultivating new capabilities for tracking their manufacturing materials and supply chains to ensure that batteries are recycled and that their component materials are recovered.

What Can We Help You Solve?

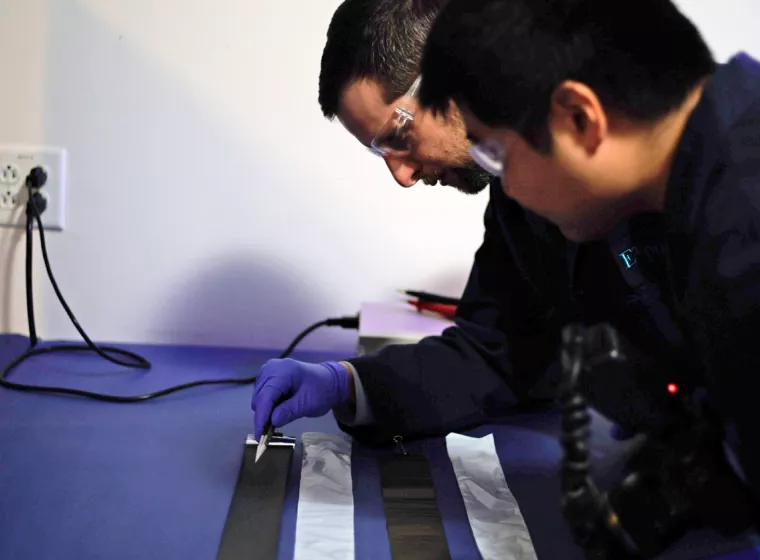

At Exponent, we support our clients from ideation to postmarket surveillance through battery design review, quality, and safety assessments. We understand the scope and intent of battery standards across industries, and we have built our reputation on leveraging cross-industry knowledge to support boundary-pushing startups and established brands alike.

Battery Design Review, Quality & Safety Assessments

State-of-the-art battery design, performance, quality, and safety assessments to support manufacturers' requirements and industry standards.

Consumer Product Design, Usage & Injury Analysis

Expert user interaction analysis to support mitigating the risk of injuries from consumer products.

Battery Supply Chain Services

End-to-end battery supply chain support including evaluating potential manufacturer partners and suppliers

Battery Failure Analysis & Investigation

Comprehensive battery failure analysis to determine the root causes of failures and identify opportunities for mitigation.

Human Factors Risk Assessments

Assess human factors risks for consumer products, industrial equipment, processes, and more.

Battery Vendor Evaluation Services

Independent, objective analyses that empower innovative, reliable battery product journeys.

Insights